Case Study

S&P 500 Portfolio Analysis

Python-driven analysis of historical S&P 500 stocks (AAPL, MSFT, NVDA, CHK) covering cumulative returns, moving averages, volatility, correlations, and diversified portfolio performance.

Summary

What we found

NVDA delivered the strongest long-term cumulative return, driven by GPUs, AI, and data centers.

CHK was the most volatile but did not translate that risk into higher returns.

AAPL and MSFT provided steady, moderate-risk growth and anchor the portfolio.

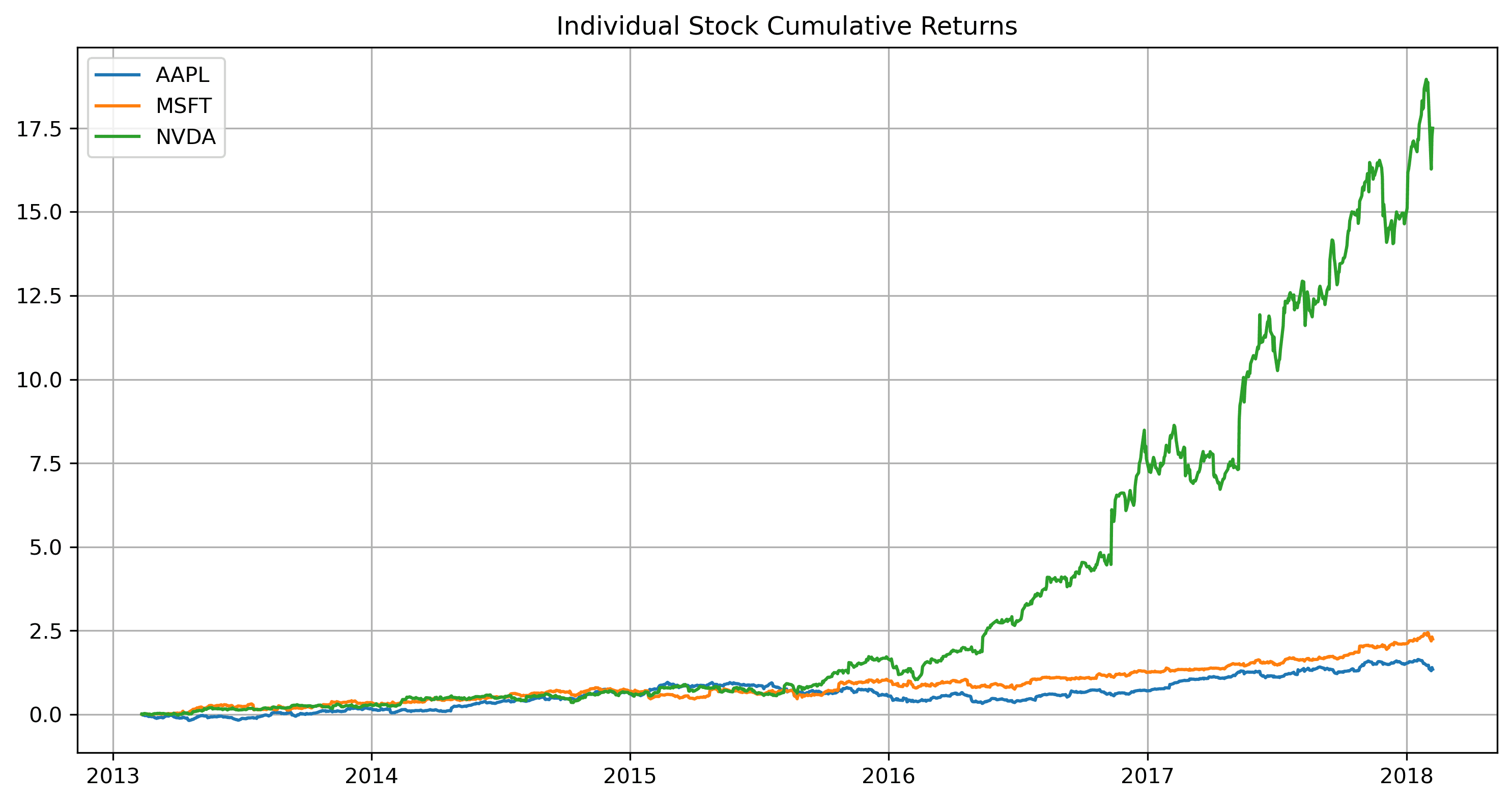

Diversification plus lower correlations (NVDA vs. AAPL/MSFT) reduced total portfolio volatility.

Details

How the analysis was structured

Introduction

- Complete, end-to-end analysis of historical S&P 500 stock data using Python, Pandas, and Matplotlib.

- Goal: explore financial time series, evaluate individual stock performance (AAPL, MSFT, NVDA, CHK), and build a diversified portfolio.

- Process: data cleaning and transformation, daily returns, cumulative curves, moving averages, volatility indicators, correlation matrix, and portfolio aggregation.

Key Insights

- NVDA emerged as the strongest long-term performer with exponential growth.

- CHK showed the highest volatility yet weak long-term performance—risk did not equal reward.

- AAPL and MSFT delivered stable, consistent returns with moderate risk—ideal anchors for diversification.

- Combining high-growth (NVDA) with steady anchors (AAPL, MSFT) improved return while lowering overall volatility.

Highlights by View

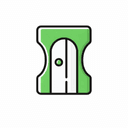

- NVDA vs CHK Cumulative Returns: NVDA’s momentum outpaced CHK’s volatile but flat performance.

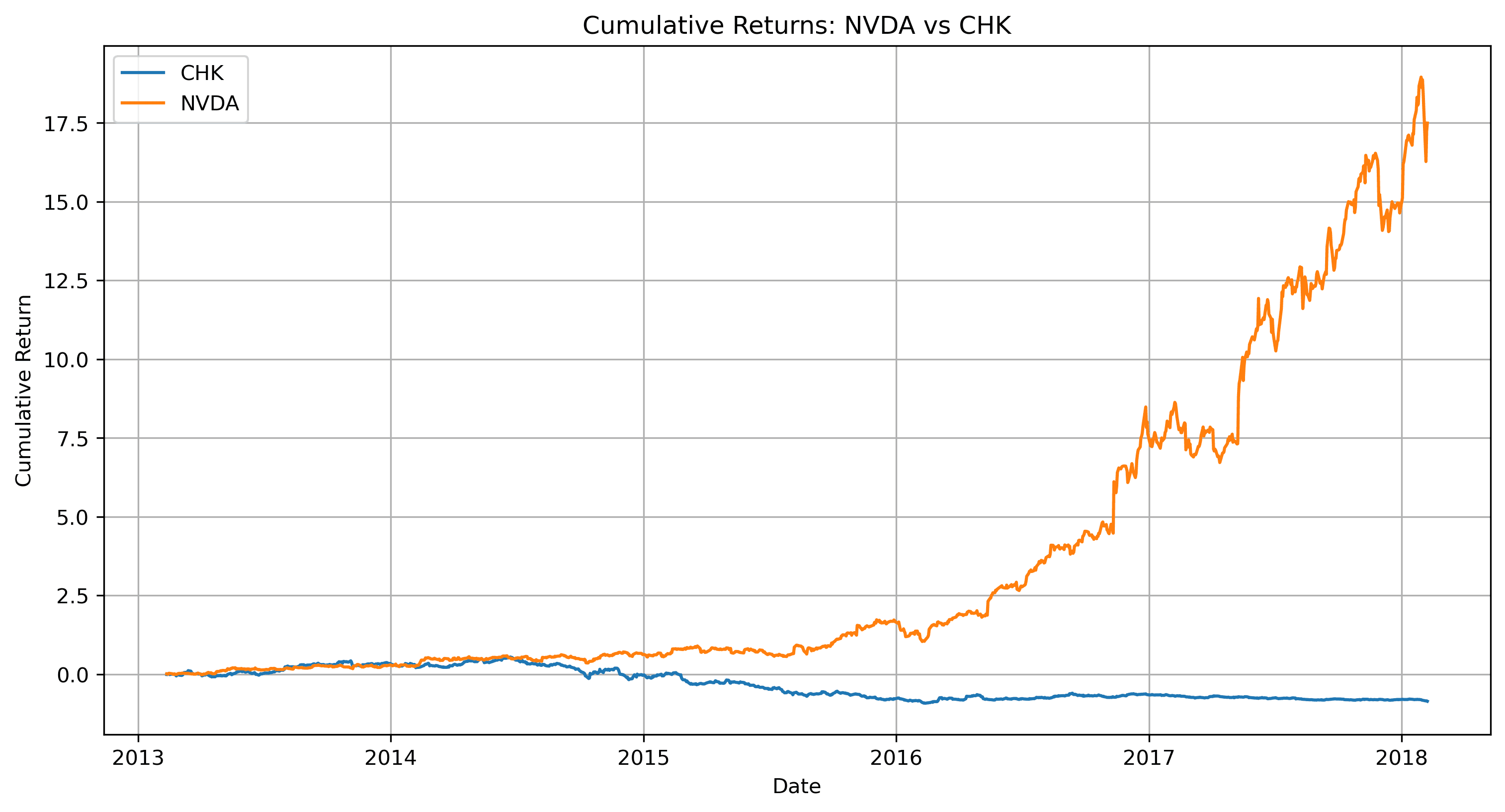

- Single-Stock Comparison (AAPL, MSFT, NVDA): NVDA led, especially post-2016; AAPL/MSFT stayed steady.

- Portfolio Performance Over Time: upward trajectory with diversification smoothing drawdowns.

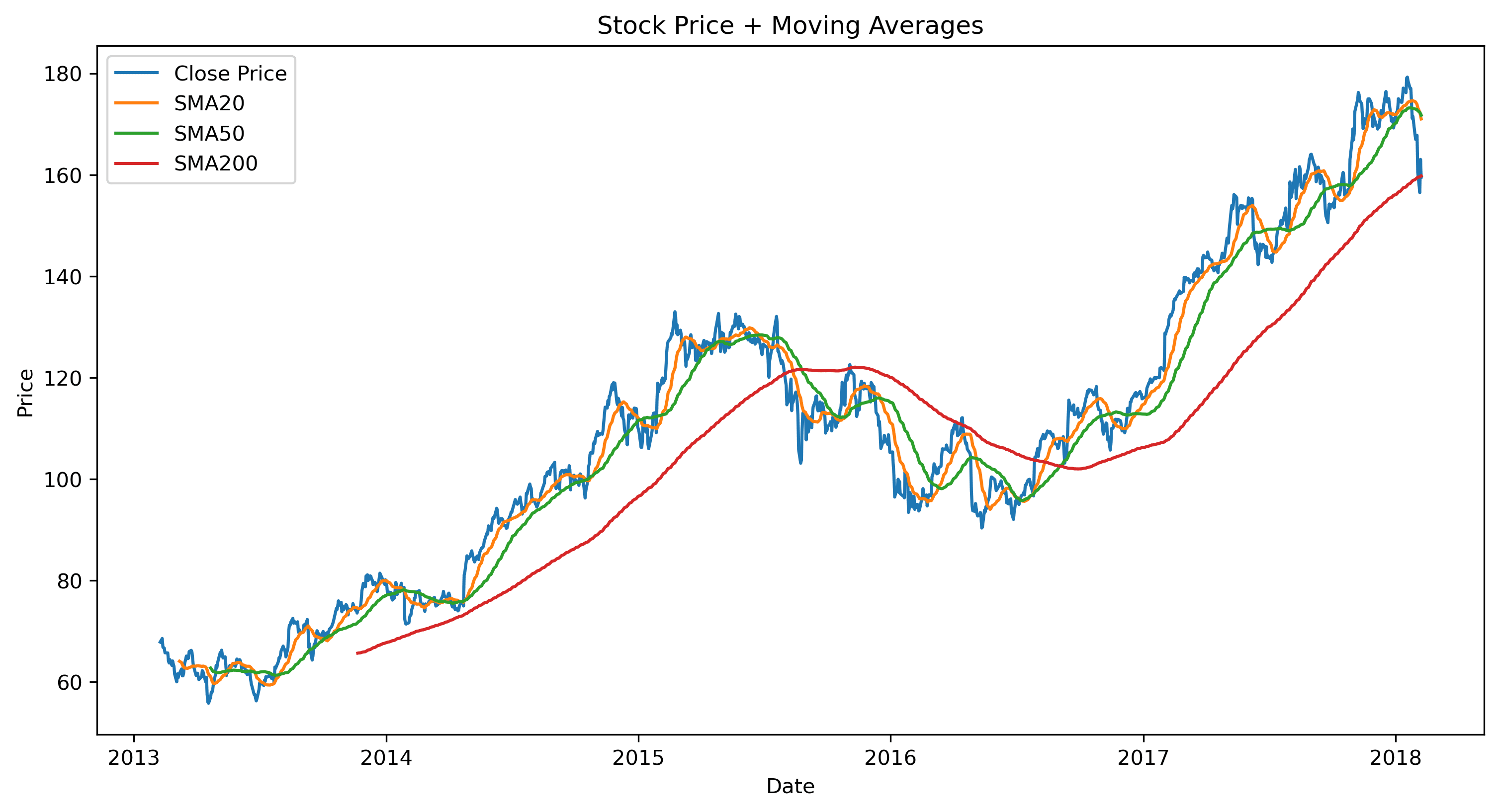

- Moving Averages (SMA20/50/200): trend-following view showing sustained bullish momentum and momentum shifts.

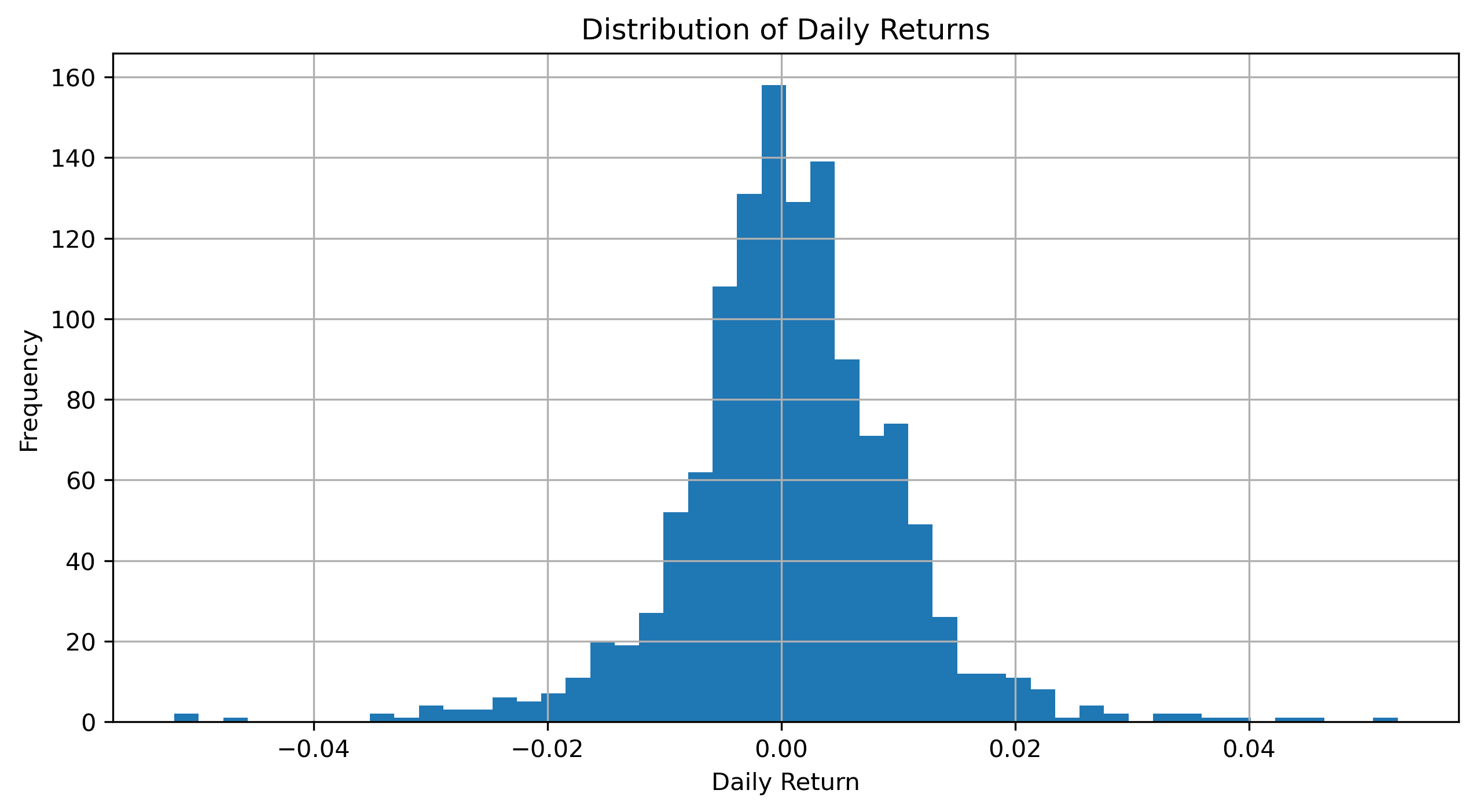

- Distribution of Daily Returns: mostly centered near zero with normal-ish shape and occasional tails.

- Correlation Matrix: NVDA’s lower correlation with AAPL/MSFT enhanced diversification benefits.

What This Demonstrates

- Diversification works when assets are not perfectly correlated.

- High-quality growth names can lift portfolio returns while anchors manage risk.

- Pairing return analysis with volatility, correlations, and moving averages gives a fuller risk/return picture.

Visuals

Charts from the analysis

NVDA vs CHK — Cumulative Returns

High return vs. high volatility: NVDA’s exponential lift compared to CHK’s flat, volatile path.

Individual Stock Cumulative Returns

AAPL and MSFT provide steady climbs; NVDA inflects sharply post-2016.

Portfolio Performance Over Time

Diversified portfolio curve with steady growth and moderated drawdowns.

Stock Price + Moving Averages

SMA20/50/200 trend-following view showing momentum shifts and long-term uptrend.

Distribution of Daily Returns

Most days cluster near 0% with occasional tails—useful for risk context.

Next step

Want this kind of analysis on your portfolio?